Transforming Fintech Operations: A Case Study on Delivering a Scalable Fintech Platform for Tramo Technolab

Introduction:

By leveraging our expertise in fintech solutions and advanced technologies, Neosprint helped Tramo Technolab transform their operations and achieve significant growth. Our customized platform, built on MERN, MEAN, and Python, coupled with robust DevOps on AWS, enabled seamless API integration and streamlined processes, empowering Tramo to serve millions of customers and facilitate secure and efficient financial transactions.

#1

Enhanced Efficiency:

Neosprint’s tailored fintech platform and advanced technologies allowed Tramo Technolab to streamline their operations and automate processes, resulting in improved efficiency and reduced manual effort.

#2

Scalability and Flexibility:

With a platform built on MERN, MEAN, and Python, coupled with DevOps on AWS, Neosprint provided Tramo with a scalable and flexible solution that could handle their growing customer base and accommodate future expansion.

#3

Seamless Integration:

Neosprint’s expertise in API aggregation and integration enabled Tramo to seamlessly connect with over 100 API partners, facilitating millions of API calls every month. This integration enhanced Tramo’s service offerings and provided their customers with a wide range of financial services.

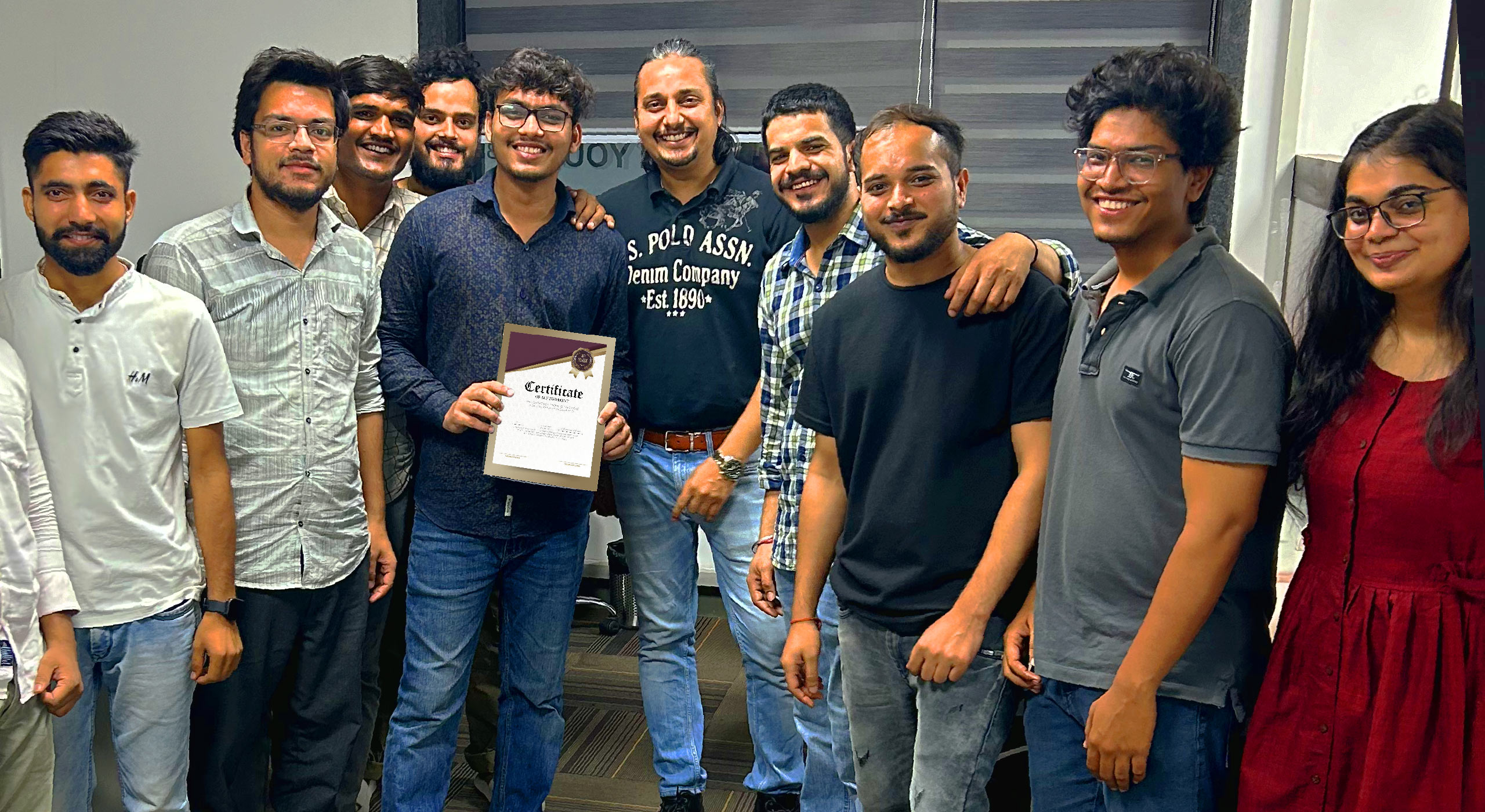

“Working with Neosprint has been a game-changer for our fintech venture. Their expertise in technology and deep understanding of the industry enabled us to build a robust and scalable platform. Neosprint’s commitment to delivering high-quality solutions and their proactive approach to problem-solving have been instrumental in our success. I highly recommend Neosprint as a trusted partner for anyone seeking innovative technology solutions.”

Rahul Das

Founder and CEO – Tramo

Client Background

Intro:

Tramo Technolab is a dynamic fintech company that was founded in October 2018. Their core capabilities include Domestic Money Transfer (DMT), Aadhaar Pay, bill payment, recharge, and Indo Nepal Transfer. With a vast network of 15,000 agents across the nation and a strong customer base of 1.2 million users, Tramo Technolab has emerged as a prominent player in the fintech industry.

The Challenge and Solution

The Challenge:

Tramo Technolab partnered with Neosprint India with the challenge of re-developing a robust and scalable and upgraded fintech platform. They required a platform that could handle high transaction volumes, integrate with 20+ Partners and providers and at the same time serve over 100 API partners, and ensure secure and seamless financial transactions. Moreover, they sought to leverage modern technologies such as MERN (MongoDB, Express.js, React, Node.js), MEAN (MongoDB, Express.js, Angular, Node.js), and Python.

Solution:

Neosprint collaborated closely with Tramo Technolab to design and develop a comprehensive fintech platform tailored to their unique requirements. Drawing upon expertise in MERN, and Python, Neosprint crafted a scalable and API aggregator platform. This platform seamlessly integrated with over 100 API partners, facilitating efficient and secure transaction processing. To ensure optimal performance and management, Neosprint implemented a robust DevOps infrastructure too on AWS.

Results

The collaboration between Neosprint and Tramo Technolab culminated in the successful delivery of an advanced fintech platform. The platform empowered Tramo Technolab to broaden their service portfolio, strengthen their distribution network, and generate substantial revenue through API-based transactions. With its scalable architecture, API aggregation capabilities, and reliable performance, the platform significantly improved customer experiences and fostered increased customer loyalty.

Conclusion

Neosprint showcased its expertise in developing and delivering a customized fintech platform for Tramo Technolab. Leveraging the potential of modern technologies like MERN, MEAN, and Python, alongside a resilient DevOps infrastructure on AWS, Neosprint enabled Tramo Technolab to revolutionize their fintech operations. The platform’s remarkable capabilities, including distribution model enablement, API aggregation, and scalable architecture, propelled Tramo Technolab to achieve their business objectives and establish a formidable presence in the competitive fintech market. This successful collaboration highlights Neosprint’s commitment to delivering innovative and scalable solutions that drive growth and success for fintech companies.

Have a business case?

Contact Neosprint today to explore how our integration solutions can help seamlessly connect your business systems, optimize operations, and enhance collaboration across your organization.